The VA loan program has long been a vital resource for veterans, active-duty service members, and certain members of the National Guard and Reserves. Originally designed to make homeownership more accessible, these loans offer unique benefits such as no down payment, competitive interest rates, and no private mortgage insurance (PMI). While many people associate VA loans with single-family homes, the program also covers multi-family properties—specifically, those with up to four units. This article will delve into everything you need to know about using VA loans for multi-family homes, including eligibility requirements, benefits, the application process, and tips for successful investment.

Understanding VA Loans

What is a VA Loan?

A VA loan is a mortgage loan backed by the U.S. Department of Veterans Affairs (VA). It was established in 1944 as part of the GI Bill to help returning veterans reintegrate into civilian life. The VA does not issue loans directly; instead, it guarantees a portion of the loan, which reduces the risk for lenders and makes it easier for borrowers to obtain financing.

Key Features of VA Loans

- No Down Payment: One of the most significant advantages is that eligible borrowers can finance 100% of the home’s purchase price.

- No PMI: Unlike conventional loans, VA loans do not require private mortgage insurance, saving borrowers money on monthly payments.

- Competitive Interest Rates: VA loans typically offer lower interest rates than conventional loans, making monthly payments more affordable.

- Limited Closing Costs: The VA limits the fees lenders can charge, making the closing process more cost-effective.

- Assumable Loans: VA loans can be assumed by qualified buyers, which can be an attractive feature when selling the property.

Eligibility for VA Loans

Who is Eligible?

To qualify for a VA loan, borrowers must meet specific eligibility criteria:

- Service Requirements: Generally, veterans who have served 90 consecutive days of active duty during wartime or 181 days during peacetime are eligible. National Guard and Reserve members may also qualify after six years of service.

- Certificate of Eligibility (COE): Borrowers must obtain a COE from the VA, which verifies eligibility. This can be done online through the VA’s eBenefits portal, by mail, or through a lender.

- Credit and Income Requirements: While the VA does not set a minimum credit score, most lenders prefer a score of at least 620. Additionally, borrowers must demonstrate sufficient income to cover mortgage payments and other debts.

Multi-Family Home Specifics

When it comes to multi-family homes, the same eligibility requirements apply. However, it’s essential to note that the borrower must occupy one of the units as their primary residence. This requirement distinguishes VA loans for multi-family homes from other investment property loans.

Benefits of Using VA Loans for Multi-Family Homes

1. Investment Opportunities

Purchasing a multi-family property using a VA loan can serve as an excellent investment strategy. By living in one unit and renting out the others, you can generate rental income that can help cover mortgage payments. This approach not only helps you become a homeowner but also allows you to build equity and wealth over time.

2. Lower Initial Investment

With no down payment requirement, you can acquire a multi-family property with minimal upfront costs. This makes it easier to get started in real estate investing, especially for first-time buyers who may not have significant savings.

3. Flexibility in Property Management

Living in one of the units gives you the advantage of being on-site to manage the property effectively. You can address maintenance issues promptly and build relationships with tenants, enhancing tenant retention.

4. Increased Cash Flow Potential

Multi-family homes typically yield higher cash flow compared to single-family homes. By renting out multiple units, you can significantly increase your income potential.

5. Long-Term Financial Security

Real estate is often a sound long-term investment. As property values appreciate, your equity grows, providing financial security for the future.

The Application Process for VA Loans

Step 1: Obtain Your Certificate of Eligibility (COE)

Before you can apply for a VA loan, you need to secure your COE. This document confirms your eligibility and can be obtained through the VA’s eBenefits portal or by contacting a VA-approved lender.

Step 2: Find a VA-Approved Lender

Not all lenders are approved to offer VA loans. Research and select a VA-approved lender who has experience with multi-family properties. It’s essential to compare interest rates, fees, and customer service.

Step 3: Pre-Approval

Once you’ve chosen a lender, complete a loan application to get pre-approved. This step involves providing financial information, including income, debt, and credit history. The lender will evaluate your eligibility and determine how much they’re willing to lend you.

Step 4: Find a Multi-Family Property

With pre-approval in hand, you can start searching for multi-family properties. Work with a real estate agent experienced in VA loans and multi-family homes to help you navigate the market and find suitable properties.

Step 5: Make an Offer

Once you’ve found a property you’re interested in, make an offer. Ensure the property meets VA minimum property requirements (MPRs) to qualify for financing. These MPRs ensure the home is safe, sound, and sanitary.

Step 6: Undergo the VA Appraisal Process

After your offer is accepted, the lender will order a VA appraisal. This step assesses the property’s value and ensures it meets the VA’s MPRs. The appraisal will help determine the loan amount.

Step 7: Closing

Upon passing the appraisal and completing all necessary inspections, you’ll move to the closing process. Review all documents carefully, understand your loan terms, and finalize the transaction.

Considerations When Investing in Multi-Family Homes

1. Market Research

Before investing, conduct thorough market research. Analyze local rental rates, occupancy rates, and the overall economic environment. Understanding the market dynamics will help you make informed investment decisions.

2. Property Management

Managing a multi-family property can be time-consuming. Decide whether you’ll manage it yourself or hire a property management company. Each option has its pros and cons, so consider your time, expertise, and willingness to handle tenant issues.

3. Budget for Repairs and Maintenance

Owning a multi-family property comes with responsibilities, including maintenance and repairs. Set aside a budget for ongoing maintenance to ensure the property remains in good condition.

4. Tenant Screening

Carefully screen potential tenants to minimize risks. Conduct background checks, verify income, and contact previous landlords to ensure you find reliable tenants.

5. Understand Local Laws

Familiarize yourself with local landlord-tenant laws and regulations. Each state has specific laws governing rental properties, so ensure you comply to avoid legal issues.

Common Challenges and How to Overcome Them

1. Property Condition Issues

Some multi-family properties may require repairs or renovations. It’s crucial to factor in potential repair costs during your budgeting process. A thorough inspection before purchase can help identify necessary repairs.

2. Managing Multiple Tenants

Handling multiple tenants can be challenging. Establish clear communication channels and consider implementing a tenant portal for easy access to important information and maintenance requests.

3. Vacancy Rates

Vacancy rates can impact your cash flow. To mitigate this risk, consider diversifying your rental portfolio and offering competitive rental rates.

4. Financing Complexities

While VA loans are advantageous, the application process can be more complex for multi-family homes. Work closely with your lender and real estate agent to navigate these challenges effectively.

Conclusion

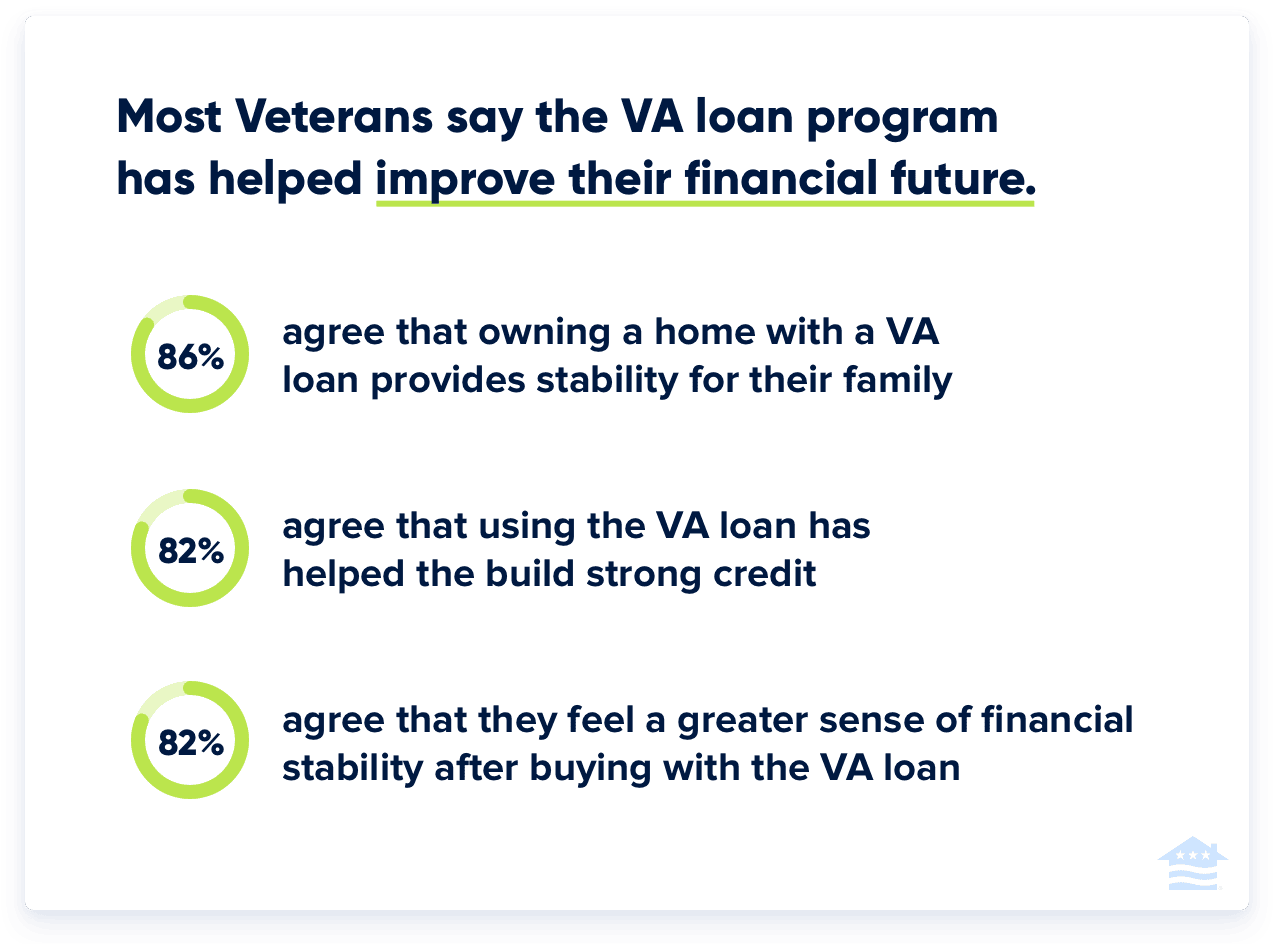

VA loans offer a unique opportunity for veterans and service members to invest in multi-family homes while enjoying numerous benefits. From no down payment to the potential for rental income, using a VA loan can be a smart financial move. However, it’s crucial to do your homework, understand the responsibilities of being a landlord, and navigate the application process carefully. By leveraging the advantages of VA loans, you can secure not only a home for yourself but also a promising investment that can enhance your financial future. Whether you’re a first-time homebuyer or a seasoned investor, VA loans for multi-family homes can pave the way to a successful real estate venture.