Navigating the complexities of real estate investment can be challenging, especially for veterans and active-duty service members looking to utilize their hard-earned benefits. Among the various financing options available, the VA loan stands out, particularly when it comes to purchasing multi-family properties. This article will explore how to maximize your benefits with a VA loan for multi-family investments, covering everything from eligibility requirements to the potential advantages of this financing option.

Understanding the VA Loan

The VA loan is a mortgage option backed by the U.S. Department of Veterans Affairs, designed to help veterans, active-duty military personnel, and certain members of the National Guard and Reserves secure home financing with favorable terms. The primary benefits of a VA loan include:

- No Down Payment: One of the most significant advantages is the ability to finance 100% of the home’s purchase price, making it easier for veterans to enter the real estate market.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, VA loans do not require PMI, which can save borrowers a substantial amount of money.

- Competitive Interest Rates: VA loans typically offer lower interest rates than conventional loans, making monthly payments more manageable.

- Flexible Credit Requirements: The VA loan program is more lenient regarding credit scores, allowing more veterans to qualify.

Eligibility for VA Loans

To qualify for a VA loan, borrowers must meet specific eligibility criteria:

- Service Requirements: You must have served a minimum period in the military, which varies depending on your service branch and the time period of service.

- Certificate of Eligibility (COE): You need to obtain a COE, which verifies your eligibility for the VA loan program. This can be done online through the VA’s website.

- Occupancy Requirement: VA loans are primarily intended for primary residences. However, when purchasing multi-family properties, at least one unit must be occupied by the borrower.

The Case for Multi-Family Properties

Investing in multi-family properties with a VA loan presents unique advantages:

1. House Hacking

Purchasing a multi-family property allows veterans to live in one unit while renting out the others. This approach, often referred to as “house hacking,” can significantly reduce living expenses. Rent collected from tenants can cover the mortgage, property taxes, and other costs, making homeownership more affordable.

2. Building Wealth

Multi-family properties typically appreciate faster than single-family homes, offering potential for greater long-term financial returns. As a real estate investor, you can benefit from cash flow, tax deductions, and property appreciation.

3. Diversification

Owning a multi-family property can diversify your investment portfolio. Rather than relying solely on the performance of a single-family home, you can spread risk across multiple rental units.

4. Increased Financing Options

With a VA loan, you can finance properties with up to four units. This flexibility allows you to maximize your investment potential without needing a hefty down payment.

How to Maximize Your VA Loan Benefits for Multi-Family Properties

To truly take advantage of the VA loan when investing in multi-family properties, consider the following strategies:

1. Choose the Right Location

Location is crucial in real estate. Look for multi-family properties in areas with strong rental demand, good schools, and access to public transportation. Areas with growing job markets are also ideal, as they attract more potential tenants.

2. Conduct Thorough Research

Before purchasing a property, conduct a comprehensive market analysis. Evaluate comparable properties, rental rates, and the overall economic landscape of the neighborhood. Understanding these factors will help you make an informed investment decision.

3. Inspect the Property Carefully

Investing in a multi-family property requires careful inspection. Hire a professional home inspector to assess the condition of the building, including plumbing, electrical systems, and structural integrity. Address any issues before closing the deal to avoid unexpected expenses later.

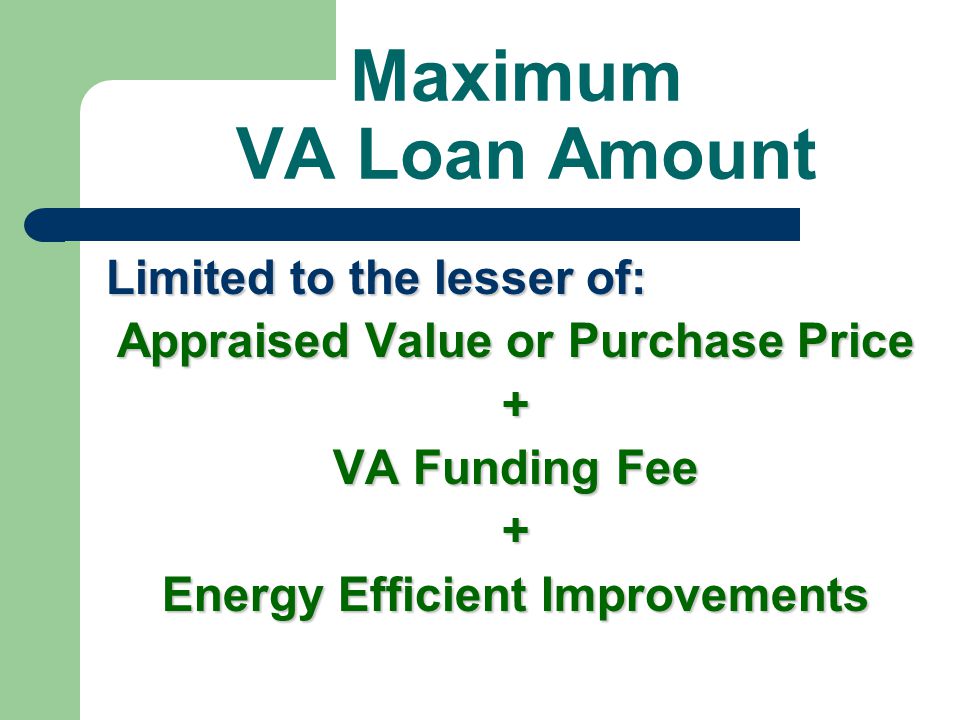

4. Understand the Financing Process

While the VA loan offers numerous benefits, understanding the application process is crucial. Work with a lender experienced in VA loans, as they can guide you through the specific requirements for financing multi-family properties. Prepare your documents, including proof of income, tax returns, and details of your military service, to expedite the approval process.

5. Utilize Additional Resources

The VA offers various resources for veterans looking to invest in real estate. Explore educational materials and workshops that provide insights into the real estate market and property management.

6. Consider Future Growth Potential

When investing in a multi-family property, consider its future growth potential. Look for neighborhoods that are on the verge of revitalization or areas where new infrastructure projects are planned. These factors can lead to increased property values and rental income.

Navigating Property Management

Once you’ve purchased a multi-family property, effective property management is key to maximizing your investment. Here are some tips:

1. Tenant Screening

Implement a thorough tenant screening process to ensure you attract reliable renters. Conduct background checks, verify income, and check references to minimize the risk of late payments or property damage.

2. Maintain Open Communication

Establish clear lines of communication with your tenants. Address concerns promptly and be approachable. Good communication fosters a positive tenant-landlord relationship, leading to longer leases and less turnover.

3. Regular Maintenance

Conduct regular property maintenance to keep your units in good condition. A well-maintained property not only retains tenants but also attracts new ones. Schedule routine inspections and address maintenance issues promptly.

4. Educate Yourself on Landlord Laws

Familiarize yourself with local landlord-tenant laws to ensure compliance and protect your rights as a property owner. This knowledge can prevent legal issues and disputes down the line.

Tax Benefits of Multi-Family Properties

Investing in multi-family properties using a VA loan can also offer several tax advantages:

1. Depreciation Deductions

As a property owner, you can benefit from depreciation deductions. The IRS allows you to deduct the cost of the property over 27.5 years, providing a substantial tax break.

2. Deductible Expenses

You can also deduct various expenses related to property management, including maintenance costs, property taxes, insurance, and mortgage interest. Keeping meticulous records of all expenses will ensure you maximize these deductions.

3. 1031 Exchange

If you decide to sell your multi-family property, consider using a 1031 exchange. This allows you to defer capital gains taxes by reinvesting the proceeds into another similar property, facilitating continued growth in your real estate portfolio.

Challenges and Considerations

While the VA loan offers significant advantages for multi-family property investments, there are challenges to consider:

1. Occupancy Requirement

As mentioned earlier, one unit of the property must be owner-occupied. This requirement can limit your ability to rent out all units immediately, especially if you are transitioning from another home.

2. Property Condition

VA loans have specific property requirements. The property must meet minimum property standards, and any significant repairs or safety issues must be addressed before closing. This can be a hurdle for investors looking to purchase fixer-uppers.

3. Market Fluctuations

Real estate markets can be volatile. While investing in multi-family properties can provide steady income, it’s essential to be prepared for potential downturns in the market that may affect rental income and property values.

Conclusion

Investing in multi-family properties using a VA loan can be a powerful strategy for veterans looking to maximize their benefits and build wealth. By understanding the eligibility requirements, conducting thorough research, and effectively managing your property, you can create a sustainable source of income while enjoying the perks of homeownership.

Whether you are new to real estate investing or looking to expand your portfolio, leveraging the advantages of a VA loan for multi-family properties can lead to significant financial rewards. With the right approach, you can successfully navigate the challenges and enjoy the numerous benefits of this unique financing option.